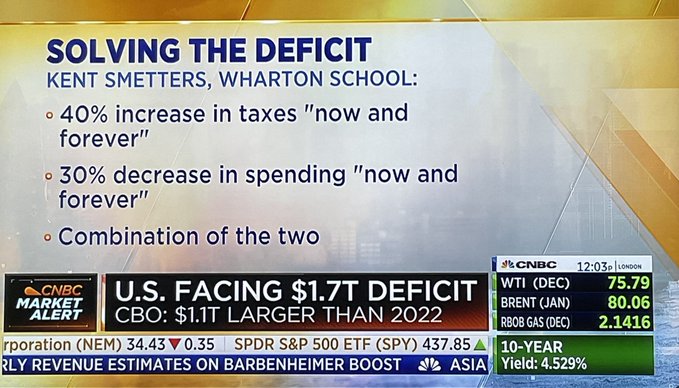

It is pretty clear that the Uniparty has no ability or intention to reduce spending. The good news is that this is a classic socialist inflation so we know what is going to happen. You might recall the Venezuelan path that I have mentioned before. For current details, try this link.

Now at $33 trillion, the Federal debt is large enough that a debt spiral is underway. The bond vigilantes are back, and the bear steepener appears to be underway in Treasuries. Regardless of what Powell does with short rates, the longer term rates will be headed up. Recall that in 1994, James Carville, a political adviser to President Clinton, famously remarked that if there were such a thing as reincarnation, he would like to be reincarnated as the bond market. By this he meant that he would like to wield the bond market’s immense power to discipline and rein in errant economic policymakers by driving up interest rates.

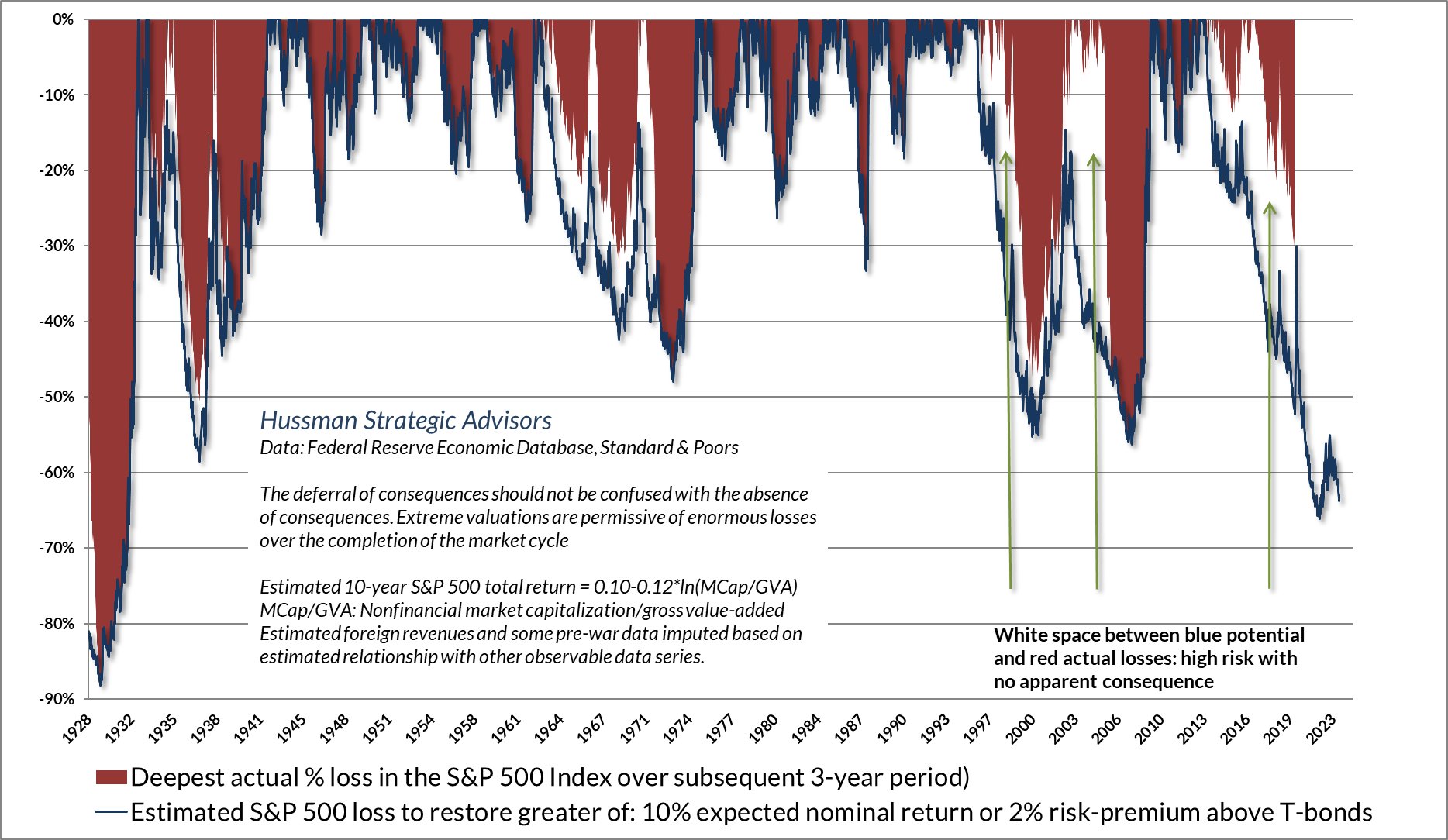

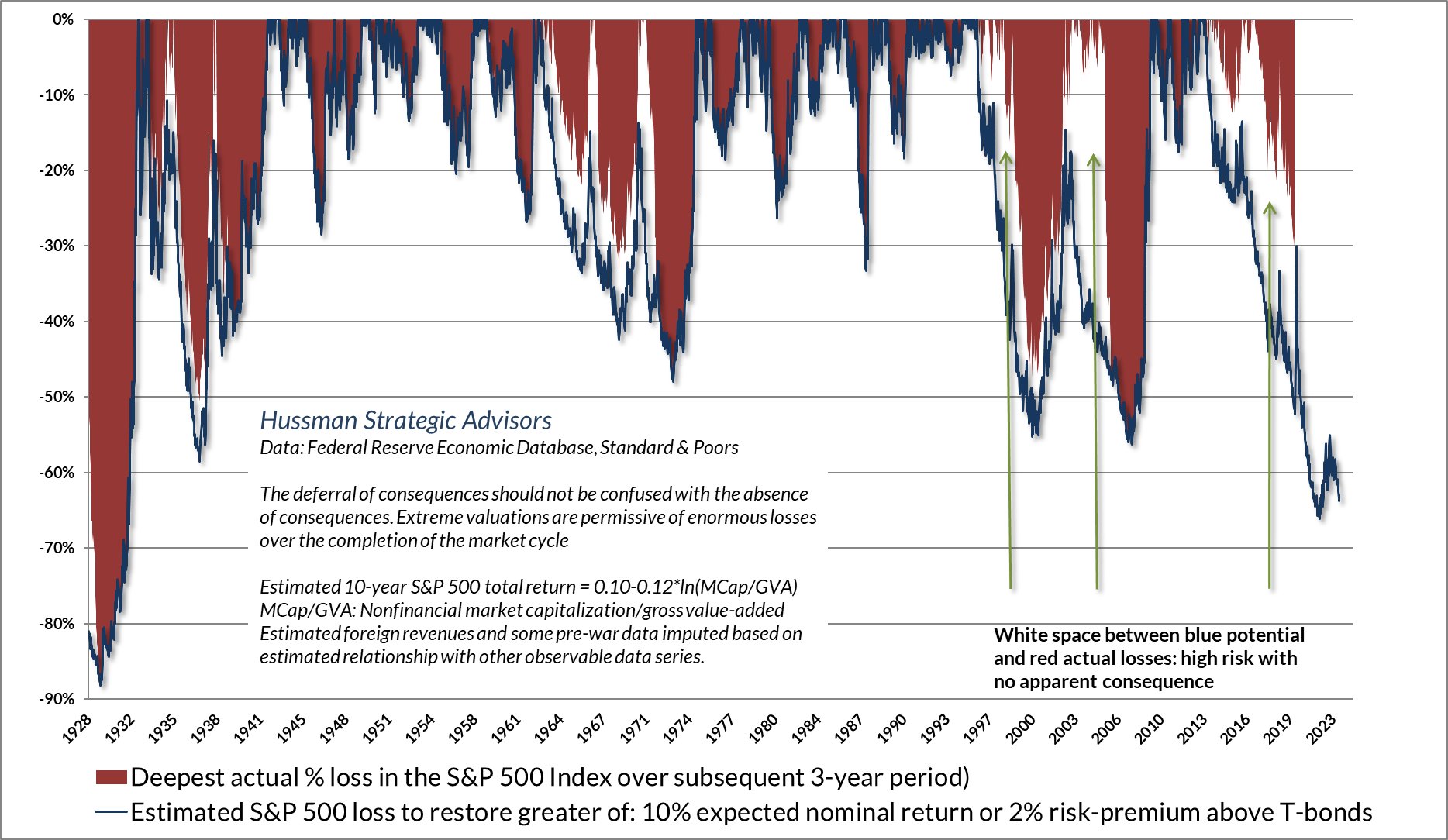

After so many years of low or negative rates asset valuations have gone to extreme heights and will now head for the opposite extremes. Defaults and bankruptcies are already rising. John Hussman’s chart, below, forecasts a 65% loss in the S&P 500.

Unfortunately many economies around the world are simultaneously in similar situations. China, for example, is struggling to deal with the collapse of its housing bubble. Some economists believe that there is enough vacant housing in China for a billion people, while population growth has turned negative. There are numerous other housing bubbles around the world (That means you, Vancouver).

While the Great Depression was deflationary, it now appears that this one will be inflationary, more like the Venezuelan model, where inflation is currently running at 400% per year. Food and energy shortages can be expected. A wild card, and not in a good way, are the globalists and their attempts to stoke fears of a global climate emergency which means the use of fossil fuels and agriculture must be curtailed or abandoned. Commodity prices may hold up well in real terms.

You must be logged in to post a comment.