Is the economy good or bad? Is it growing or shrinking? Mr Bernanke and the mainstream economists all direct us to watch the GDP, or Gross Domestic Product to answer these questions. Of course, this is completely misleading as one might expect from a group of people who get pretty much everything wrong.

If you want to answer those questions, there is a pre-question to ask. What constitutes a good economy (or a bad one)? What does an economy need to do to earn a merit badge?

We must look to the purpose of the economy to answer the pre-questions. We need to go back to Adam Smith and his famous discussion of the pin-makers that illustrated the division of labor. Even the most primitive of peoples divide the labor of sustaining daily life – for example, the men might be the hunters while the women raise children and tend the home fires. This is a recognition that specialization improves overall productivity. Once people specialize in production, then we need to build the infrastructure that supports the exchange of goods and services between specialists so that, to the extent possible, everyone gets a share although not necessarily an equal share. For example, a blacksmith needs food but the community is better off if he spends his days at his forge while the farmers supply him with food – in exchange for plows, scythes, horse-shoeing services and so forth.

Modern society is no different. The purpose of the economy is to improve everyone’s standard of living by increasing the quantity of goods and services delivered to people for their personal consumption. So if we want to know how the economy is doing, that is what we need to measure.

That is not what GDP measures. Just think of the old gulag practice of assigning a crew to build a wall, and then another crew to tear it down. Then another crew rebuilds it and the cycle repeats. The economists would count both the construction and the destruction of the wall as production, so the faster the wall is built and destroyed again, the higher GDP becomes. But it is pointless activity and no wall results. Measuring this way allows Mr Bernanke and the other economists to claim the economy is growing when in fact it is not, because many of the goods and services produced do not benefit anyone.

A more relevant example will be the rebuilding after last week’s tragic earthquake and tsunami. That will boost Japan’s GDP. But it is merely offsetting a vast loss relative to a week ago, which is not subtracted from GDP. People are far worse off than they were a week ago, and an immense reconstruction effort will be needed to get them back to some approximation of where they were before. This is Bastiat’s “that which is not seen.” It is not seen because the accounting is bogus. If you are going to use GDP, you need to subtract GDDD&O – Gross Domestic Destruction, Discarding, Depreciation and Obsolescence.

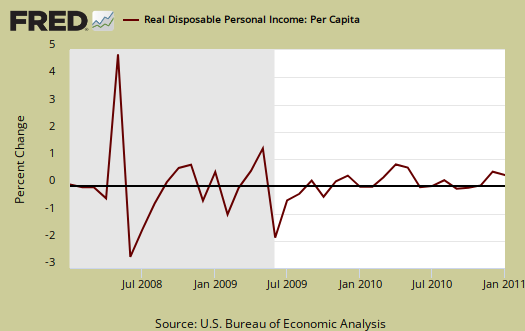

Where do we look, then? Well, we can start here:

This chart shows how much income people have that they can spend, on a per capita basis. It is closer, but it fails to acknowledge that fact that more than 20% of personal income is borrowed money – borrowed by the Federal government. Leaving that aside, it is clear that GDP and personal income lead one to two very different conclusions.